How we can leverage cross-selling in Health Insurance Sector

Helping Standalone Health Insurance provider with cross-sell opportunity for product variants

Cross-selling is an important practice in the corporate world, which should be dealt very carefully without affecting consumer sentiments. The aim of cross-selling is to increase revenue from the existing customer by selling different products of one company and at the same time maintaining a healthy relationship with them.

For example:-

- When a customer shops for party wear, the salesman convinces the customer to purchase the necessary accessories that match the outfit.

- If a customer has a bank account, the banker would try to convince the customer to invest in Mutual Funds

Cross-selling is very essential for every company for the following reasons:

- Revenue generation

- Customer loyalty

- Improved Customer satisfaction

- Increase customer retention

- Increased Customer base

According to an article in Marketing Metrics,

Odds of selling a product to a new customer – 5-20%

Odds of selling to an existing customer – 60-70%

Also, it costs 5 to 8 times more to sell to a new customer than to an existing customer

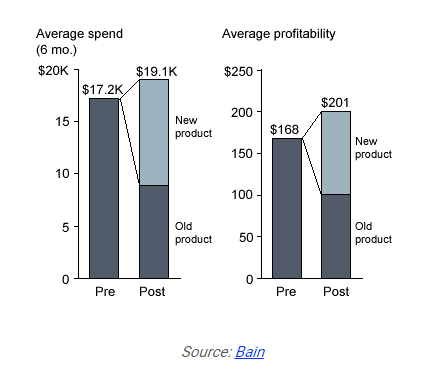

Cross-selling the new product would increase individual customer spend and profitability.

To build a cross-sell model to drive sales for existing customers

Focus Areas –

- What – choice of product

- Whom – the selection of customers

- When – timing

- How – contact strategy

Cross-sell in Healthcare Insurance:

Combo plan of Accidental Insurance and other health plans

Most financial advisors would suggest getting health and life insurance plans together. These combo plans are more in demand for the people who don’t like approaching different insurances for life and health and would prefer a single place to get the cover from. It also simplifies the task of searching for different products, buying and maintaining the same.

Dental Care plans

Even though you have Health insurance, it would be recommended to take a supplementary plan/ second plan which would be cost effective as well as beneficial for the customer. Dental treatment is costly, averaging 5% of total health expenditure.

Vision Insurance

Vision insurance is generally supplemental to other types of medical insurance policies. Vision insurance helps offset the costs of routine checkups and vision correction wear that may be prescribed. Vision problems include serious medical conditions such as glaucoma, cataracts, diabetes, and even cancer. Vision insurance can be a part of the annual medical check-ups, for purchasing glasses, lenses or contacts.

How does Pentation Analytics help in Cross-selling?

Identifying Opportunity – The product grid is used to identify combo plans.

Customer Segmentation – Identify the right customers based on Age, Marital Status, Average Ticket Size, Sum Insured, Base Premium

Propensity Modelling – Determine the probability of cross-selling a product to the existing customer

Timing of Cross-sell – Predict the right time to pitch the products to existing customers based on inter-purchase time of similar customers

Cross-sell Strategy – Recommend a cross-sell strategy or campaign and measure the effectiveness of the campaign

The process followed by Pentation:

We summarize data and generate the report, create and validate customer id, further on we build models using algorithms and select the best product.

Phases followed: