InsurTech-Driven Distribution – For a Future-Ready Intermediary

The Disruption Wave

A lot has been talked and discussed about the “Disruption wave” that’s approaching with the growth of InsurTech. How much of it is real?

If we look at top InsurTechs of the world, they primarily focus on distribution. Hence in the Insurance value chain, the major impact would be on the Insurance Intermediary.

The schools of thought may differ upon one question – if Insurance is a commodity or not.

But the global reality is that the Intermediaries are the ones holding relationships with the end customer.

But is the value-add enough to survive?

InsurTechs use Artificial Intelligence, Machine learning and automation to make Insurance distribution frictionless. Digital payments, online market place, transparent processes, personalized services, fast turnaround time etc. are making insurance purchase an Amazon like experience.

And YES, Customers love this!

Conclusion – Adoption and Evolution is the key of survival and growth.

A Future-Ready Agent (Intermediary)

Data is the fuel for InsurTechs – and the intermediaries have it in all shapes and forms.

Data is stored like gold in a locker, which doesn’t grow in value. How does one put all the unused unexplored data to use?

Insurance, as an industry, is heavily reliant on conventional knowledge, which runs on intelligence of core central team. A model that has been resilient needs to breaks through –

“Democratization of knowledge”

When the data starts speaking, and intelligence is accessible to all across the organisation, we travel the journey from knowledge-based decision making to data-driven decision making. And this is precisely what the industry needs at this moment.

With the experience of working with more than 40 intermediaries across geographies, Pentation has seen the spectrum. Summarizing the learning, Intermediaries need value additions at three levels:

1) The Foundation (Data Foundation):

Capturing data is the first step, then Hygiene, Sanctity, and the right form of storage creates an Analytics-ready data environment.

2) The Cake (Machine Learning):

Resources are limited, so prioritization is key. Artificial Intelligence and Machine Learning unravel hidden trends and insights from data – essential to decipher customer behavior.

Sustainable Growth: Prioritizing resources in the right direction to target retention, cross-sell and process optimization ultimately maximizes Customer Lifetime Value(CLTV).

3) The Icing (Applications):

Intelligence should be accessible by the right person at the right time in the right form.

In such a scenario, applications with frictionless UI that offer security and access-controls are enablers.

Pentation Analytics: Transforming the Insurance Distribution Landscape

Pentation hits the nail on the head by offering an all-in-one insurance-specific software suite powered by Machine Learning – Insurance Analytics Suite™.

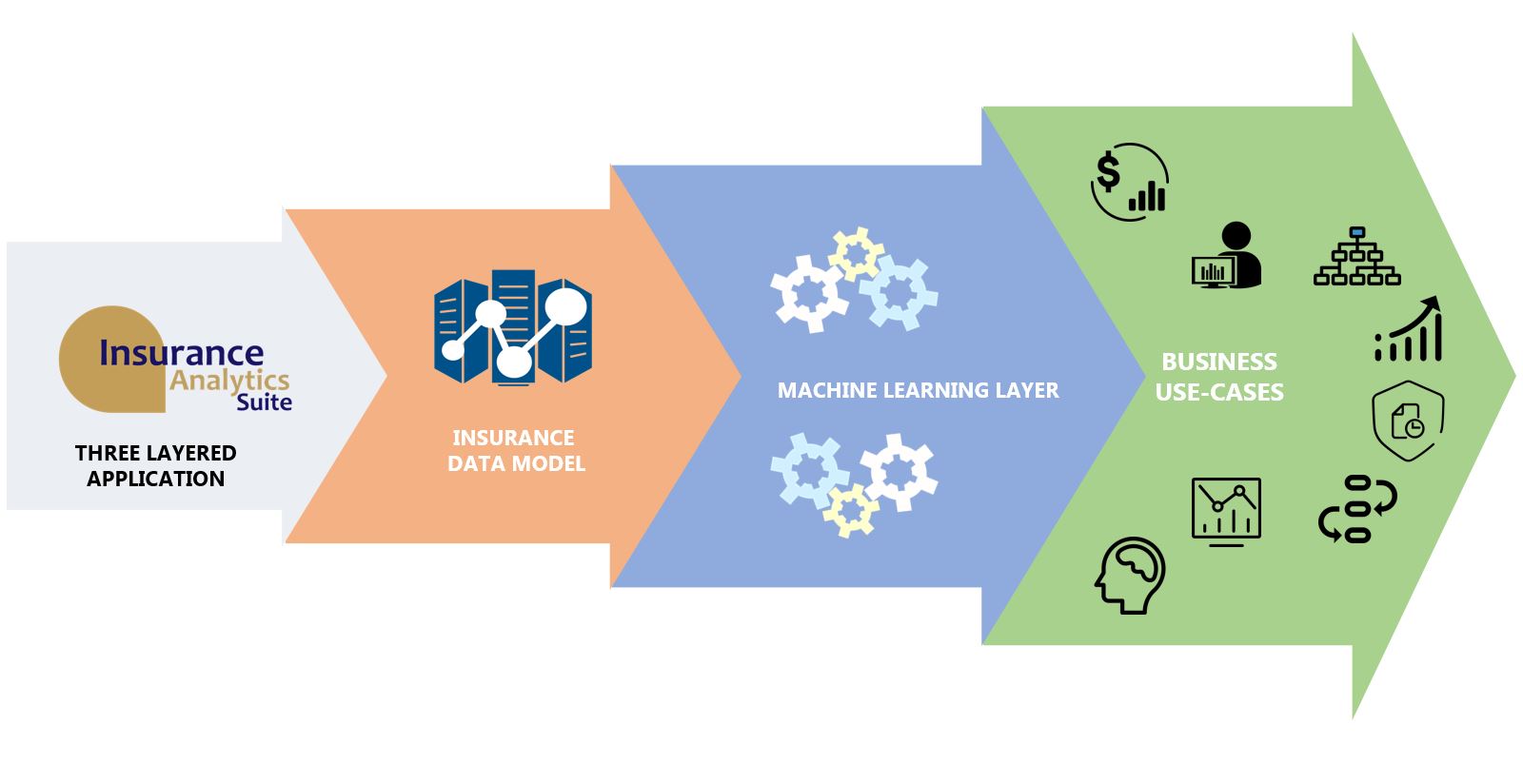

Addressing the needs and challenges of intermediaries, Insurance Analytics Suite™ comes with three layers – Insurance Data Model, Machine Learning Layer, and Business Use-Cases. This layered format ensures that the Suite takes care of everything from data management, risk insights, to planning monitoring and execution – all at one place.

The Suite allows the intermediary to navigate right from customer business intelligence to actions, as well as modify this intelligence as per his specific needs. In totality, Insurance Analytics Suite™ offers a unique combination of underwriting and process excellence – a first across the global Insurance industry.