Insurtech in Banks fueling Next-Gen Bancassurance

Bancassurance has proved as one of the most productive distribution channels for insurers – this being even truer for emerging markets with low penetration and limited distribution mediums.

With the insurance industry (long seen as a traditional sector) currently undergoing a significant period of change (the name of this change being InsurTech), an emerging trend for bancassurers in both emerging and mature markets is to adopt the route of InsurTech-collaboration to realize the true potential of the channel.

Digitization

An increased focus by bancassurers on digital channels is emerging . Online/direct channel development tends to vary by country depending on their different stages of market and technological development, market conditions and consumer demand – the need for these online bancassurance distribution models is to adapt to consumer preferences and varying needs.

Customer Centricity

Insurers value their bank partners on how well they know their customers in terms of financial and demographic profiles, their ability to retain customers, and to integrate and scale distribution and product offerings.

Traditionally, bancassurers have targeted the mass market, but today the need is to leverage technology to finely segment the market and create tailored products for specific groups of consumers.

What is required? Banks analyzing customer preferences and insurers manufacturing products in tandem with their bank partner’s recommendations and requirements. In this process, InsurTechs can play an instrumental role in developing comprehensive customer propositions via technology; the ultimate value-add being delivering real-time pricing and customized product designs.

Technology

Insurtechs use Machine Learning in varying degrees to improve processes across the bancassurance value chain – from sales and marketing where client and sales data are being used to identify and target the best leads for marketing (e.g., propensity-to-buy modelling, distributor quality management, preferred risk selection, etc.); to underwriting (propensity to complete purchase); in-force management (cross-sell and up-sell models, proactive lapse management, customer value management); through to claims (claims triage and non-disclosure or fraud).

With InsurTechs enabling banks to make the most of their skyrocketing data, which was in past considered redundant, bancassurance models are perfectly disposed for optimization.

Collaboration with Insurers

For bancassurance to be optimally successful, however, a deep integration between the bank and insurer needs to exist. Effective data integration among banks and insurers can result in creation of high-value leads. Needs-based selling, effective cross-selling and marketing of customized products are essential in today’s competitive marketplace.

With bank data, Insurtechs can enable bancassurers to utilize analytics approaches and maximize distribution as well as generate new business. A bancassurance plan based on innovative products targeted to specific consumers will allow insurers to capitalize on existing opportunities and expand into new market segments.

Insurance Analytics Suite for Bancassurance

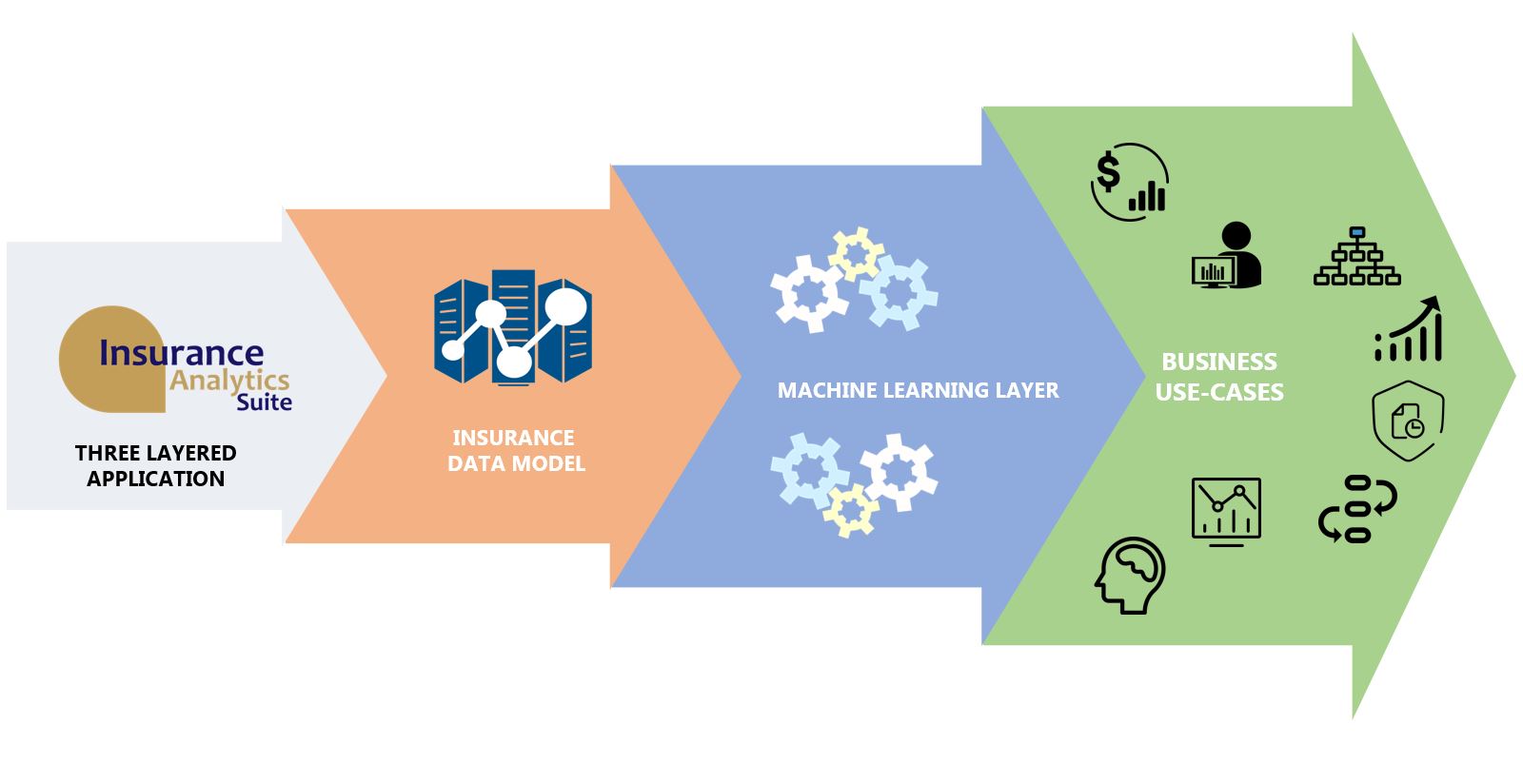

Pentation Analytics is one such InsurTech that is tech-enabling organizations and helping them digitize. With Insurance Analytics Suite™, an all-in-one insurance-specific software suite powered by Machine Learning, Pentation empowers bancassurers with a deep-dive into real-time disposition of their customers through customer-level intelligence (derived from structured and unstructured data and leveraged through Machine Learning), driving strategic actions to increase customer retention and cross-sell/upsell.

To shift the onus from data analysts to the business owners (who are by default better-suited to make the most of the business analytics processes), Insurance Analytics Suite™ is designed for the business user top-of mind. This is done through developing it into a three-layered platform – Insurance Data Model, Machine Learning Layer, and Business Use-Cases.

This layered format ensures that the Suite takes care of everything from data management, risk insights, to planning monitoring and execution – all at one place. Insights are topped by interventions, which drive underwriting decision-making along with process efficiency.