Key to Insurers’ Success? Maximizing Value Of and For Existing Customers

To quote Philip Kotler, “appreciating and satisfying customer needs are key to success. Focusing on customers and creating loyal relationships are very important in a world characterized not by a shortage of goods but by a shortage of customers.”

Putting this in the Insurance context – who largely determine the profitability of an insurance company are its customers. This makes it fundamental for insurers to identify and quantify the needs of the policy holders. Value of and for customers should be measured and maximized as it’s a fact that loyal and satisfied customers create value for insurance companies.

Today, the key determining factors for an insurer’s value are –

a) the value of market segments (current and future),

b) customers value (current and future), and

c) the ability of the insurance company to reproduce and to increase this value in subsequent cycles of the sale of insurance products.

A Marathon, Not a Sprint

Insurance companies compete to offer the most desired deals to their customers for their satisfaction. However, this nowhere implies that a customer gets satisfied and turns loyal immediately; the results come with consistent work – research on and keeping up with customers’ wants and demands, backed by supportive efforts (promotional offers, discounts, free or discounted insurance), which inevitably lead to customers preferring and promoting the quality they start to associate the company with.

Customers cannot just buy an insurance product – they ought to feel great about it. In emerging markets, insurance industry faces basal challenges such as a lack of awareness about policies and products, low quality of services, prolonged claim settlement, tedious and lengthy document filing work among more. Owing to these, insurance still accounts for a push rather

than a pull market.

The Answer? Retain and Cross-sell!

All implies that due to the general perception towards industry, the problem lies at the customer acquisition stage itself – further meaning that insurers must work toward establishing a strong grip on existing customers, who hold the potential of bringing them business again and again, and if treated well, would also help strengthen brand image causing more customer acquisitions.

In other words, true success for insurance companies lies in none other than customer retention. And these retained customers by default form grounds for cross-sell and upsell.

Customer retention has for long been undervalued, with companies investing more in acquiring new customers, resulting in decreased ROI. With time, they realized that tweaking organizational structure a bit and making use of already existing database and social media, they can work wonders on retaining customers.

The customer today wants to keep the communication short and crisp. The days of long boring brochures, emails and phone calls are over; it’s the era of personalized communication, where social media emerges as a hero. The idea is to understand your customers, create specific approaches over mass targeting, generate delight for the customers – and they will be glued to your organization for a good while!

Insurance Analytics Suite – Addressing Customer Retention and Cross-sell

Ideating customer-specific actions requires customer-level intelligence – which Insurance Analytics Suite is essentially designed to deliver. The insurance-specific analytics platform, powered by machine-learning, uses policy transaction data and customer interaction data. The result is insights in form of scores of risk of renewals and cross-sell, which enable interventions ensuring overall profitability for insurers and intermediaries.

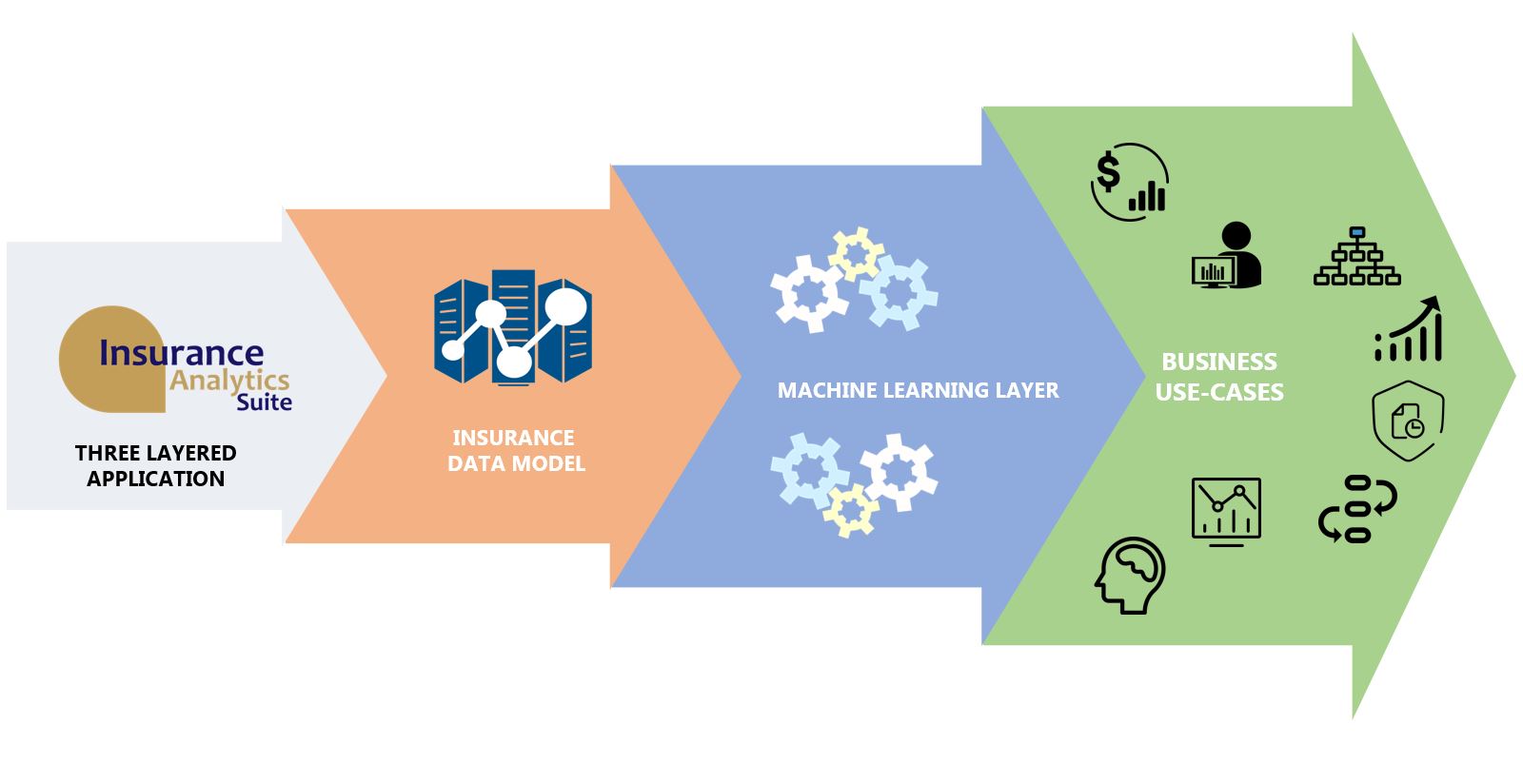

The aim is to shift the onus from data analysts to the business owners (who are by default better-suited to make the most of the business analytics processes). Pivoting this thought, Insurance Analytics Suite™ is designed for the business user top-of mind. This is done through developing it into a three-layered platform – Insurance Data Model, Machine Learning Layer, and Open Applications Layer.

This layered format ensures that the Suite takes care of everything from data management, risk insights, to planning monitoring and execution – all at one place. Insights are topped by interventions, which drive underwriting decision-making along with process efficiency.