Rising InsurTech – Recasting Insurance

InsurTech as merely causing digital disruption is today a thing of the past – its purview has now expanded to reshaping the industry through innovation and collaboration. There is no turning back and insurers need to adapt fast to sustain and make the most of this opportunity. Pentation Analytics is fervently driven, aimed at catapulting insurers globally to overcome the strategic gap that arises as a result. Even though InsurTech is currently at an embryonic level, new innovative business models within the insurance industry have emerged, such as Insurance Analytics Suite by Pentation Analytics.

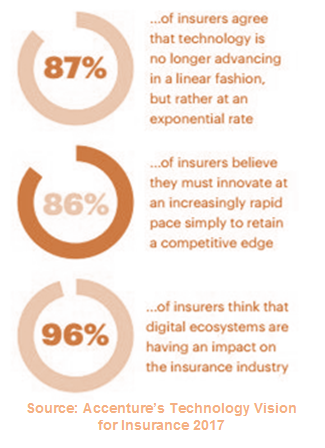

The Insurance business—assessing risk, collecting premiums and paying claims—has not changed much since its inception. However, it has been witnessing a technological watershed for some time now, and has embarked on a radical transformation. In 2016, the insurance sector was in the midst of the FinTech revolution, with InsurTech disruption on the mind of 74% of insurers.

Today, while most still see business as being at risk, according to researches, InsurTech is becoming more widely understood and accepted. While in 2011 InsurTech startups received $140 million in funding from 28 total deals, investment increased more than tenfold in 2016, with investors pouring nearly $1.7 billion into 173 deals. According to PwC’s 2017 Global InsurTech Report, 45% of insurers are currently partnered with InsurTech players, whilst a staggering 94% have aligned their priorities closer to emerging trends and AI-led risk insights and customer engagement. Given the massive opportunity to innovate within the industry, these trends are projected to continue.

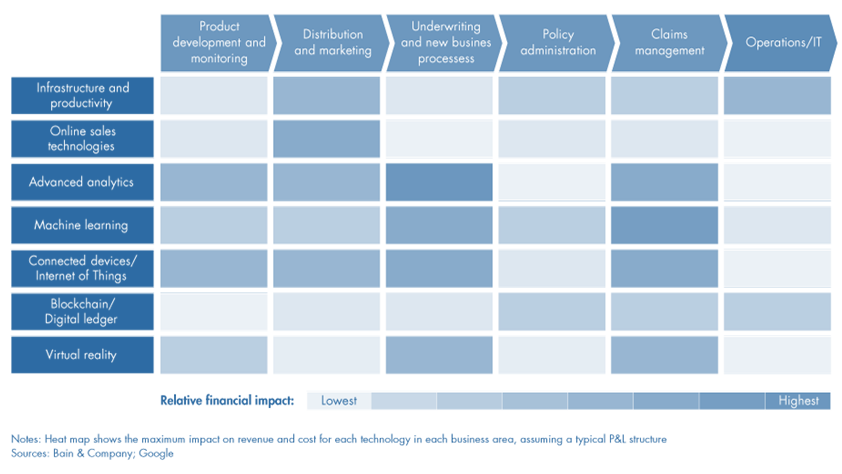

Seven key technologies recasting the industry through and through, basis researches and analyses conducted by Bain and Company, Google, are –

- Infrastructure and productivity – State-of-the-art IT architecture is critical for digital innovation. Insurers are found to consider the cloud the best option for processing, computation and storage. They can also use productivity tools such as co-authoring and video calling, and they can connect with their customers through a seamless, omni-channel approach.

- Online sales applications – Insurers use cutting-edge techniques for targeting customers, identifying user groups and analyzing consumption patterns.

- Advanced analytics – With AA, insurers gain extensive insights into customer needs and preferences. Insurers can also draw on it to help fight fraud.

- Machine learning – With machine learning, insurers’ information systems quickly adapt to new data, without the need for re-programming. Insurers use machine learning to shape underwriting, price products and manage claims.

- The Internet of Things – Networked devices in cars and buildings can protect people and property and facilitate proactive, preventive maintenance, thus reducing accidents—and claims. By analyzing data from sensors embedded in vehicles and other equipment, insurers can gain insights into customer behavior.

- Distributed ledger – By arranging and documenting claims on distributed ledgers, insurers can greatly reduce processing time. A whole new field has come into existence for smart contracts—that is, policies that are fully automated and updated based on a blockchain’s entire database.

- Virtual reality (VR) – This technology has the potential to transform the way information for underwriting is gathered, as well as the way claims are settled; for instance, an insurer could use VR to create a three-dimensional image of a room or to reconstruct an accident in minute detail.

InsurTech and Customer-perspective

In the hyper connected modern economy, consumers expect goods and services to be convenient and easily accessible. For consumers buying insurance, however, the experience is often confusing, frustrating and riddled with hard-copy forms and fax-machine-level technology. Submitting and settling claims is no better. In fact, the insurance industry has one of the lowest levels of customer satisfaction of any industry. Given this, many startups have focused on improving the existing distribution and claims-handling models, offering AI-enhanced policy advice, digital purchasing platforms and lightning-fast issuance of policies. But innovation in this space raised questions from industry participants. In particular, it is to be observed whether changes like digitization, automation and advances in chatbots and robo-advisors constitute a threat to brokers, or simply an opportunity to better service clients.

Thus, there is no gainsaying that the new technologies will be worthwhile for consumers, bringing variety in choices, improved service, and cost-advantage. The players in the industry have begun to realize the enormous potential this holds for them – those who have already entered this ecosystem and use digitalization as an opportunity to rethink all their operations, from underwriting to customer service to claims management have experienced the difference. Insurers are no longer required to dispatch human adjusters to gather facts and evaluate accident damage. Using machine learning, automated advisers can draw on virtual reconstructions of the accident and a wealth of background data. They may as well enter into a digital dialogue with customers and immediately inform them where any damage can best be repaired.

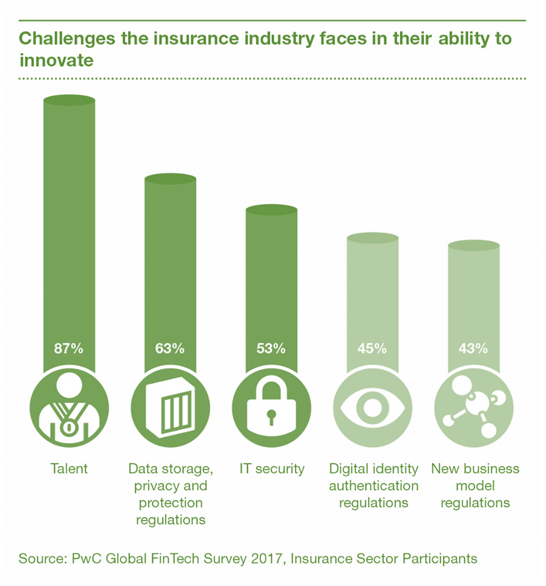

Insurance firms are disrupted; disrupting and going through important digital transformation projects, often revolving around the need to optimize the end-to-end customer experience. Insurers can improve their policy, distribution and claims functions, and benefit from modern data management, advance analytics and dashboarding through BI tools. A common saying around the time goes by “InsurTech is not a silver bullet—the real challenge for insurers is to become more innovative in their everyday business.”

There has been, as it requires, a shift in the perspective to look at the overall customer life-cycle and be more customer-centric in order to reduce costs and increase revenue. For insurers battling in a fiercely competitive marketplace, digitalization is a multi billion-dollar opportunity. Using digital tools, insurers can lift profits, while delivering new services, lower premiums and an all-around better experience to their customers.